THE CASE LAWYER

ISO CERTIFIED LAW FIRM

IN ISLAMABAD

Special Services for Overseas Pakistanis

Ranked No. 1 Information Technology Law Firm in Pakistan

Ranked No. 1 Information Technology Law Firm in Pakistan

iTechLaw is a project of The Case Lawyer that deals with the technology laws and resolve legal issues of technology businesses. Our professionals can understand the technical legal compliance in technology industry.

Overseas Pakistanis Legal Services is a project of The Case Lawyer that deals with the legal problems of our Overseas Pakistanis as they require an efficient and accessible platform for redressal of their grievance.

Offshore Filings is an international project of The Case Lawyer that helps our clients to get registered their business, regulatory compliance and intellectual property in international jurisdictions being a non-resident.

Legal Services for Overseas Pakistanis

Family Disputes

Best Family Lawyer in Islamabad for Overseas Pakistanis

Muslim Divorce

Best Lawyer for Muslim Divorce (Shia & Sunni) in Islamabad

Christian Divorce

Christian Divorce & Christian Family Disputes Lawyer in Islamabad

Child Adoption

Best Child Adoption Lawyer in Islamabad for Overseas Pakistanis

Child Custody

International Child Custody Lawyer for Overseas Pakistanis in Islamabad

Child Maintenance

Experienced Child Maintenance Lawyer in Islamabad for Overseas Pakistanis

Wife Maintenance

Best Wife Maintenance Lawyer in Islamabad for Overseas Pakistanis

Second Marriage

Hire Our Best Lawyer for Second Marriage Disputes in Pakistan

Online Marriage

Online Marriage through Internet and Modern Devices in Pakistan

Inheritance Disputes

Best Inheritance Disputes Lawyer in Islamabad for Overseas Pakistanis

Guardianship Certificate

Best Guardianship Lawyer in Islamabad for Overseas Pakistanis

Power of Attorney

Power of Attorney Registration & Attestation Services for Overseas Pakistanis

Property Ownership Disputes

Property Ownership Disputes of Overseas Pakistanis

Property Rent Disputes

Property Rent Disputes Between Landlords and Tenants in Islamabad

Domestic Violence

Best Lawyer against Domestic Violence for Overseas Pakistanis

Pakistani Citizenship Disputes

Acquisition and Renunciation of Pakistani Citizenship

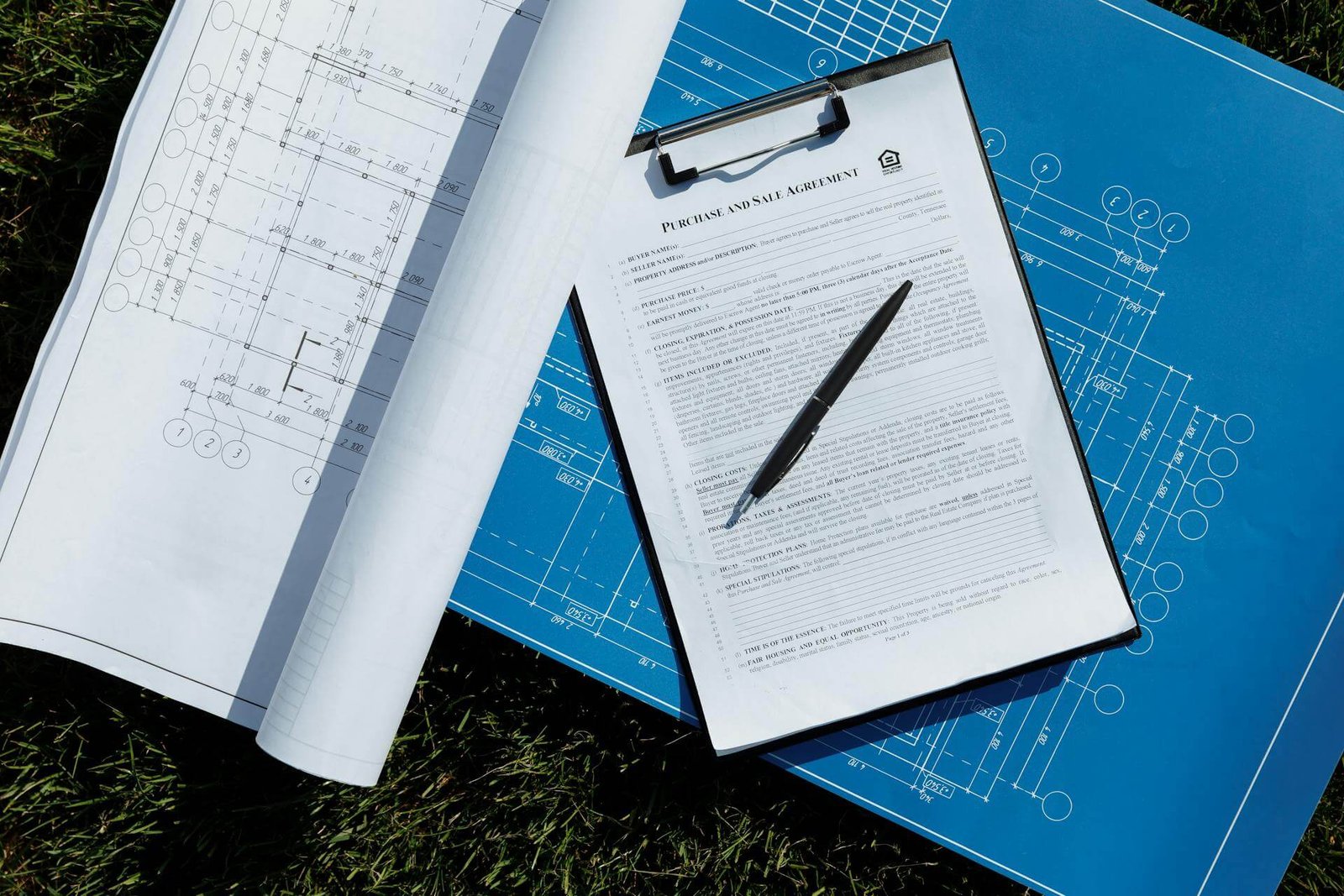

Property Transfer & Registration

Transfer and Registration of Property for Overseas Pakistanis

Overseas Pakistanis Legal Services

Legal Services for Overseas Pakistanis in Pakistan

Internet and E-Commerce Laws

Internet & E-Commerce

Specialized Lawyers in Internet and E-Commerce Laws

Social Media Laws

Best Lawyer for Social Media Regulation in Pakistan

Domain Name Dispute

Legal Services for Internet Domain Name Dispute

Online Brand Protection

Special Lawyer for Online Brand Protection in Pakistan

Online Piracy Protection

Internet Piracy and Anti-Counterfeiting Enforcement Lawyer in Pakistan

DMCA Legal Services

Special Lawyer for DMCA Notice and Takedown

Amazon Brand Registry

Best Amazon Brand Registry Lawyer in Pakistan

Amazon Seller's Lawyer

Best Amazon Seller's Lawyer and Legal Services in Pakistan

Electronic Agreements

Legal Drafting Lawyer for Contracts & Electronic Agreements

Business Registration Services in Pakistan

PVT Company

Private Limited Company Registration in Pakistan

Sole Proprietorship

Sole Proprietorship Business Registration in Pakistan

Partnership Firm

Registration of Partnership Firm in Pakistan

Foreign Company

Liaison Office & Foreign Company Registration

I.T Company

I.T Company Registration in Pakistan

Software Company

Registration of Software Company

Call Center

Registration of Call Center Business

PSEB Registration

Pakistan Software Export Board (PSEB) Registration

Real Estate Company

Real Estate Company Registration Services in Pakistan

Construction Company

Complete Registration of Construction Company in Pakistan

Chamber of Commerce

Registration with the Islamabad Chamber of Commerce

DOCUMENTS TRANSLATION & ATTESTATION

Documents Translation

Certified Document Translation & Registration Services

Document Notarization

Document Notarizations and Attestations in Islamabad

UAE Attestation

Documents Attestation from UAE Embassy in Islamabad

Divorce Registration

Divorce Deed Drafting & Registration Certificate in Islamabad

Contract Drafting

Contract Drafting & Agreement Registration Service

Power of Attorney

Power of Attorney Registration & Attestation Services in Pakistan

STUDY AND VISIT VISA SERVICES

Study & Travel Visa Services

Travel to U.K, Georgia, Australia and Canada for Study and Visit

U.K Standard Visitor Visa

Best Consultant for United Kingdom Tourist Visa in Islamabad

Visitor Visa of Canada

Best Consultant for Canada Visit Visa in Islamabad

CONTACT AND LOCATIONWe are here for you

24 hours a day, 7 days a week

HOURS:

Mon to Sat: 9am – 5pm

ADDRESS:

Office No. 25, First Floor of Al-Inayat Mall, G-11 Markaz, Islamabad.

EMAIL:

clients@thecaselawyer.com

Contact The Case Lawyer

Contact The Case Lawyer

VERIFIED & RANKING NO. 1 ON GOOGLE

THE CASE LAWYER

Main Saddar, Rawalpindi

Sector G-11, Islamabad

Sector F-10, Islamabad

clients@thecaselawyer.com

SERVICES

QUICK LINKS

Our Offices

Pakistan | United Kingdom | USA | Canada | Australia | France | Germany | UAE | Europe | Middle East